Pakistan to Finalize IMF Staff-Level Deal for $1.24B Tranche

Introduction

Pakistan is nearing the completion of a crucial staff-level agreement (SLA) with the International Monetary Fund (IMF) that will unlock the $1.24 billion tranche under its Extended Fund Facility (EFF). This financial milestone is expected to stabilize the nation’s economy, strengthen reserves, and reinforce investor confidence.

The IMF’s support remains vital for Pakistan as it continues navigating through fiscal imbalances, high inflation, energy deficits, and a fragile external account position. The new deal represents not only a financial boost but also a renewed commitment to deep structural reforms demanded by the international lender. Pakistan IMF deal, staff-level agreement,Pakistan Finalize, IMF tranche 2025, Pakistan economy, IMF Extended Fund Facility, economic reform Pakistan.

This comprehensive analysis explores the details of the IMF deal, the macroeconomic environment surrounding it, policy conditionalities, the potential benefits and risks, and Pakistan’s overall strategy for economic recovery in 2025 and beyond.

1. Background: Pakistan’s Recurring IMF Dependence

Pakistan has turned to the IMF more than twenty times since its independence. Each program aimed to restore macroeconomic stability but often faced interruptions due to weak implementation, political instability, and structural bottlenecks.

The latest program — a $7 billion Extended Fund Facility — was designed to strengthen fiscal discipline, stabilize the rupee, enhance governance, and push for energy reforms. However, recurring challenges such as delayed privatization, power sector losses, and weak tax collection have continued to constrain growth.

The government’s renewed focus on an SLA signals its intention to restore international confidence and secure a stable financial trajectory after several months of economic turbulence.

2. The Economic Context Behind the IMF Talks

Pakistan’s economic situation in 2024 and early 2025 remained fragile, characterized by:

-

Inflation above 20%, driven by food and energy costs.

-

Foreign exchange reserves hovering between $8–10 billion, barely covering a few weeks of imports.

-

Currency depreciation, with the rupee under consistent pressure against major currencies.

-

Large fiscal and current account deficits that limited fiscal flexibility.

-

Energy circular debt exceeding ₨3.1 trillion, weighing on the budget.

-

Political uncertainty, delaying structural decisions and investor confidence.

This environment made IMF assistance inevitable for Pakistan’s economic survival and future policy credibility.

3. Inside the $1.24 Billion Tranche

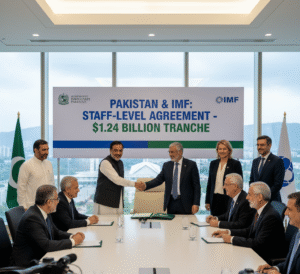

The $1.24 billion tranche is part of a larger multi-tranche arrangement within the 37-month Extended Fund Facility and the parallel 28-month Resilience and Sustainability Facility (RSF).

The SLA approval indicates that Pakistan has broadly met the IMF’s quantitative and qualitative performance criteria, including fiscal discipline, monetary restraint, and progress on energy reforms.

Once the IMF Executive Board ratifies the SLA, Pakistan will immediately receive the funds, which will be directed toward:

-

Bolstering foreign exchange reserves.

-

Supporting budgetary financing and external debt servicing.

-

Reducing fiscal pressure through temporary liquidity relief.

4. IMF Conditions: The Path to Fiscal Responsibility

To secure the SLA, Pakistan has agreed to implement strict reforms. These include:

a. Fiscal Consolidation

-

Maintaining a primary surplus through better tax collection and expenditure control.

-

Rationalizing subsidies and eliminating non-targeted fiscal support.

-

Ensuring realistic public sector development spending within available fiscal space.

b. Tax Reforms

-

Broadening the tax base to include agriculture, retail, and real estate sectors.

-

Digitizing the Federal Board of Revenue (FBR) for improved compliance and data integration.

-

Reducing tax exemptions and ensuring equitable tax distribution across income groups.

c. Energy Sector Reforms

-

Adjusting electricity and gas tariffs to cost-recovery levels.

-

Minimizing circular debt through governance restructuring of power distribution companies.

-

Introducing competitive bidding for renewable energy projects to reduce costs.

d. Monetary and Exchange Rate Policy

-

Continuing tight monetary policy until inflation moderates.

-

Maintaining a market-based exchange rate to reflect external conditions.

-

Avoiding administrative controls that distort the foreign exchange market.

e. Governance and Transparency

-

Strengthening state-owned enterprise (SOE) oversight and audits.

-

Implementing anti-corruption frameworks to enhance transparency.

-

Introducing performance-based evaluations for public officials handling financial projects.

f. Climate and Sustainability Measures (RSF Component)

-

Integrating climate resilience into national development plans.

-

Investing in flood protection, water management, and green infrastructure.

-

Aligning with renewable energy and low-carbon transition goals.

5. How the IMF Deal Benefits Pakistan

5.1 Macroeconomic Stability

The inflow will replenish Pakistan’s foreign exchange reserves, stabilizing the rupee and reducing volatility in import markets.

5.2 Restored Global Confidence

International creditors, including the World Bank, ADB, and bilateral lenders, often follow the IMF’s lead. The deal’s success encourages additional inflows from other partners.

5.3 Fiscal Space for Development

The tranche allows temporary relief for development spending, enabling the government to maintain critical infrastructure and social programs.

5.4 Reduced Default Risk

The IMF’s endorsement mitigates the risk of sovereign default and enhances Pakistan’s creditworthiness among investors and rating agencies.

5.5 Catalyst for Reform

Conditionalities act as a discipline mechanism, compelling the government to implement overdue reforms in taxation, energy, and privatization.

6. Key Challenges to Implementation

While the deal offers stability, it brings equally tough challenges.

a. Political Instability

Political transitions and populist pressures may undermine reform momentum. Governments often delay difficult steps, such as tariff hikes or subsidy removals, during election cycles.

b. Inflation and Cost of Living

Tight monetary policy and reduced subsidies may exacerbate short-term inflation, straining households already facing high food and energy prices.

c. Weak Institutional Capacity

Implementation requires efficient governance. Pakistan’s bureaucratic hurdles and inter-provincial coordination issues may delay results.

d. Social Resistance

Reforms that raise costs often face opposition from trade unions, industrial groups, and low-income households, creating social unrest risks.

e. Dependence on External Assistance

Long-term reliance on IMF and other external sources restricts policy autonomy, perpetuating a cycle of borrowing and austerity.

7. Privatization Drive and Investment Plans

The government has announced its intention to accelerate privatization of state-owned enterprises, including Pakistan International Airlines (PIA), power distribution companies, and select industrial units.

The move aims to:

-

Reduce fiscal liabilities.

-

Attract foreign direct investment (FDI).

-

Improve service delivery through private-sector efficiency.

Additionally, Pakistan plans to issue its first Green Panda Bond in Chinese markets by the end of 2025, followed by re-entry into global bond markets in 2026. These measures complement IMF-led reforms by diversifying funding sources and supporting sustainability initiatives. Pakistan IMF deal, staff-level agreement,Pakistan Finalize, IMF tranche 2025, Pakistan economy, IMF Extended Fund Facility, economic reform Pakistan.

8. The Broader Regional and Global Dimension

The IMF’s engagement with Pakistan comes at a time of heightened global economic uncertainty. Trade tensions between major economies, fluctuating oil prices, and regional security concerns influence Pakistan’s economic outlook.

South Asian economies are also adjusting to climate-related disruptions, rising import bills, and capital outflows. Pakistan’s success in stabilizing its economy could set a positive precedent for the region.

9. Long-Term Structural Priorities

For sustainable recovery, Pakistan must move beyond stabilization and focus on growth-oriented reforms:

-

Export Diversification: Boost value-added sectors like IT, pharmaceuticals, and textiles.

-

Energy Efficiency: Invest in renewables and upgrade outdated power infrastructure.

-

Agricultural Modernization: Improve productivity through technology and irrigation reforms.

-

Education & Skills: Align workforce development with emerging industrial demands.

-

Digital Economy Expansion: Promote fintech, e-governance, and digital tax collection systems.

10. The Road Ahead: Scenarios and Outlook

Best-Case Scenario

The SLA is finalized smoothly, the tranche is disbursed, and Pakistan maintains fiscal discipline. Inflation moderates, reserves strengthen, and investor confidence improves.

Moderate Scenario

Pakistan meets most IMF benchmarks but faces delays in structural reforms. Growth remains modest, but macro stability holds.

Worst-Case Scenario

Political resistance or administrative failure delays implementation. IMF funds are withheld, reserves decline, and inflation spikes, creating renewed instability.

To ensure success, the government must uphold its reform promises, maintain transparency, and engage the public through clear communication on why these reforms are essential for long-term stability.

11. Conclusion

The $1.24 billion IMF staff-level agreement represents a vital opportunity for Pakistan to restore fiscal health and market credibility. It reflects a critical intersection between economic necessity and political will.

If implemented sincerely, the deal could mark a turning point — shifting Pakistan from short-term crisis management to long-term structural reform. However, without consistent execution, fiscal discipline, and institutional accountability, the gains could quickly erode.Pakistan IMF deal, staff-level agreement,Pakistan Finalize, IMF tranche 2025, Pakistan economy, IMF Extended Fund Facility, economic reform Pakistan.